Winthrop Capital Management is an SEC-registered investment advisor specializing in the management of equity, high-grade and high yield fixed income portfolio management. We partner with financial advisors and institutions to provide several investment strategy options tailored to each client’s specific needs.

Prior to founding Winthrop, Greg built and led two institutional investment teams that managed multibillion-dollar portfolios.

Today, Winthrop employees are expected to act on behalf of clients and with mutual respect for the team.

Winthrop Capital Management holds itself to the following values:

In 2016, we began building our independent software platform, WOMBAT®, which enhances the capabilities of our investment team in several ways, including data analysis and trading operations. Wombat® also enhances reporting through the WOMBAT RiskScore™, which analyzes volatility of securities to quantify the level of risk. WOMBAT® has supported our internal operations since 2017, and we continue to invest in innovative technology to expand its capabilities. In March of 2018, we launched Winthrop Technology Solutions, LLC as a branch of our firm.

FIND OUT MORE

We continually strive to achieve the highest standard of excellence in all that we do. This defines the culture of our firm.

As an SEC-registered investment advisor, we have a fiduciary duty to put our clients’ interests first. We operate at the highest ethical standards as outlined by the CFA Institute.

We are lifetime learners and recognize that we need to continue to learn in order to grow. Every employee strives for excellence in all that he or she does, both within the firm and for our clients.

We seek to question and analyze to get to the truth rather than accept what is provided at face value. Our form of capitalism has evolved over the past decade and will continue to evolve, requiring a higher level of scrutiny when considering economic and market data.

All employees are expected to have well-reasoned and researched opinions. In our investment process, there is no hierarchy. The most junior level person can challenge anyone’s opinion. We see worth in divergent views and believe it is a gift to work alongside outstanding people with differing backgrounds and opinions.

We are a process-driven team. From the way we construct and manage our portfolios to our internal operations, we believe our processes build reliability and enable us to systematize what works.

We believe accountability rests within a person – not a committee. Each member of our team has the responsibility to do what’s right for the client, acting as an advocate for their interests.

We’re always open to the possibility of welcoming like-minded professionals to our team.

EXPLORE CAREER OPPORTUNITIES AT WINTHROP

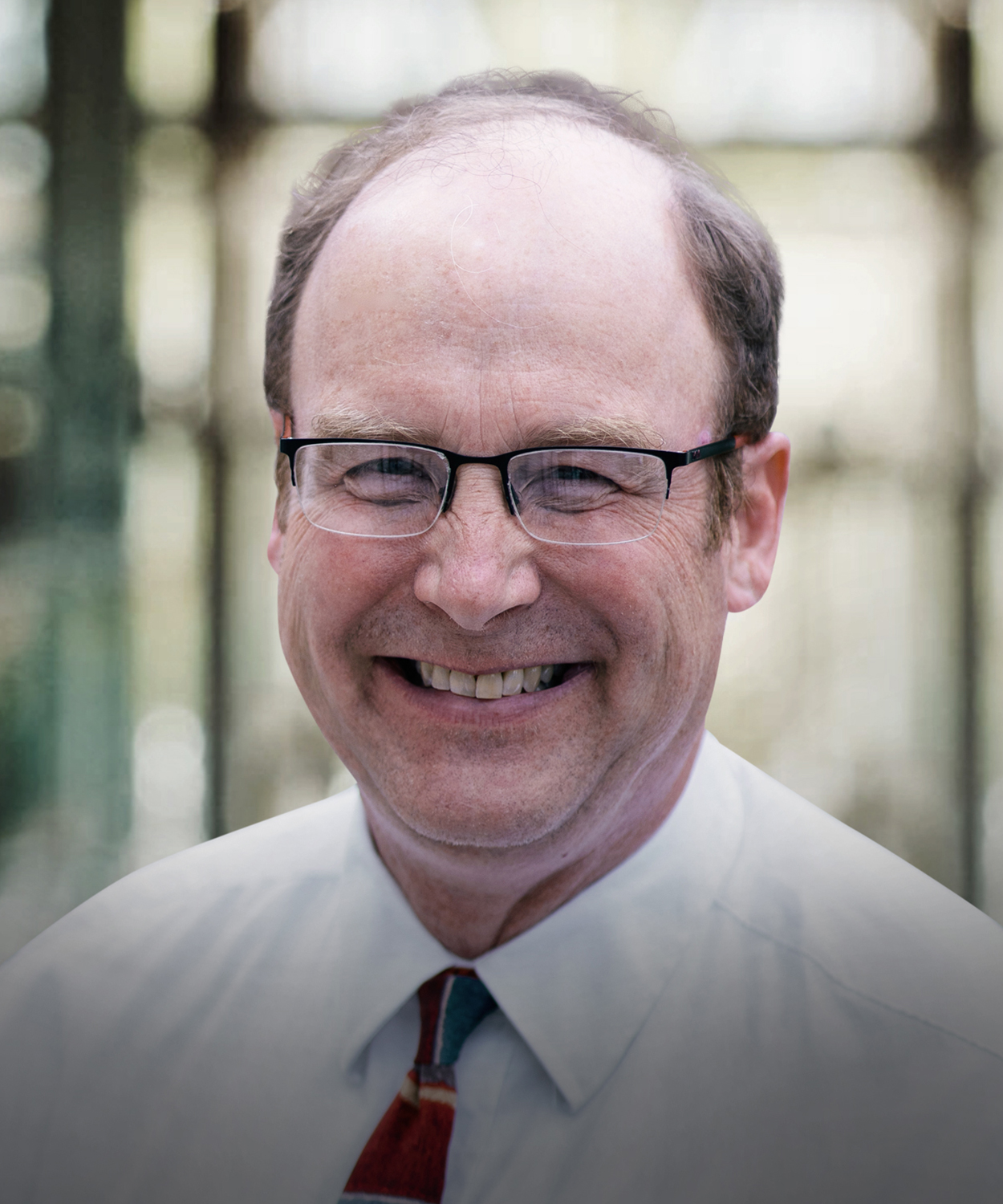

A founding partner at Winthrop Capital Management, Greg Hahn leads the investment committee and is responsible for overseeing the firm’s portfolio management, investment strategies, and security selections.

Prior to forming Winthrop Capital Management, Greg was the Chief Investment Officer and Senior Portfolio Manager for Oppenheimer Asset Management and its subsidiary, Oppenheimer Investment Management. There he was responsible for the oversight of the fixed income investment process. Greg also served as the Chief Investment Officer and Senior Portfolio Manager with Conseco Capital Management (40|86 Advisors). In addition to his investment management responsibilities at CCM, Greg was President and Trustee of the 40|86 Series Trust and the 40|86 Strategic Income Fund. Also, Greg had responsibility for the $1.2 billion real estate and private equity portfolio.

He holds a B.B.A. from the University of Wisconsin and an M.B.A. from Indiana University. He is a Chartered Financial Analyst, a member and former President of the CFA Society of Indianapolis, a former Trustee of the Indiana Public Employee Retirement System and has served as a member on the ACLI’s Committee on State Regulation of Investments. He also serves as an independent trustee of the FEG Absolute Access Fund, LLC and is a member of the National Federation of Municipal Analysts.

Adam leads the investment committee and is responsible for overseeing the firm’s portfolio management, investment strategies, and security selections.

Adam began his career in investment management at Winthrop in 2013 as a trader and research analyst. Since then, he has played a vital role in the growth and success of the firm and was named Co-Chief Investment Officer in 2024. He was integral in expanding Winthrop’s insurance asset management capabilities, including derivative hedging, capital efficiency models, and regulatory compliance.

Adam received his B.S. in Finance from Indiana University, Kelley School of Business in 2013. He has also been a CFA charterholder since 2018.

John leads the software development initiative within Winthrop Technology Solutions and Winthrop Capital Management.

In his responsibilities, John leads the team and the development of the WOMBAT™ system and our proprietary compliance software. John received his B.S. in Chemistry from Purdue University.

Emi helps to coordinate Investment Operations within Winthrop Capital Management. Her primary responsibilities include data analytics, performance attribution and performance evaluation reporting. She also assists the Chief Investment Officer with running the month-end and quarter-end reporting process. Emi received a B.S. in Finance and an M.B.A in Applied Analytics from University of Indianapolis.

Jay is responsible for designing, implementing, and monitoring the processes by which the firm complies with all applicable laws and regulations.

Jay also provides legal counsel to the President and advises the firm on a variety of legal issues, including developing and leading legal strategy to promote and protect the firm’s matters, maintaining proper corporate interactions with relevant local, state, and federal governmental bodies, and overseeing the delivery of legal services and resources to accomplish firm goals, strategies, and priorities.

Prior to joining Winthrop Capital Management, Jay worked for nine years in private practice, spending time at small and large law firms. Jay earned a B.A. from Wabash College, double majoring in Economics and Political Science, and a J.D. from the Indiana University Maurer School of Law. Jay has twice been named to the Best Lawyers in America “Ones to Watch” list for Corporate Law.

Keith is responsible for research in Investment Grade and High Yield Corporate Debt and Equities.

Prior to joining Winthrop Capital Management, Keith was a Consulting Analyst with the State Teachers Retirement System of Ohio, following the consumer discretionary sector. Previously, he was an Analyst and Portfolio Manager at both Ohio National Financial Services and Johnson Asset Management. He received his B.S. in Business Administration with a specialization in Finance from Marquette University and is a CFA charter holder.

Freddy’s primary responsibilities include managing the equity and fixed income strategies, trading, and securities research.

Freddy manages the equity models, which include Large Cap Blend, Focused Growth, and Dividend Growth. Additionally, he assists the Chief Investment Officer in developing and implementing strategies and managing total return fixed income portfolios. Freddy handles sector analysis, with a focus in Communication Services, Healthcare and Pharmaceuticals. He received his B.A. in Economics from DePauw University and joined the firm in 2017.